Uncategorized

Tune In to Fox Business Network for a Half Hour with Retirement Experts Ryan & Tyson Thacker

Considered the country’s leading experts on Social Security, find out how to maximize your benefits with Retirement Brothers Ryan and Tyson Thacker. By: Spotlight Television The Retirement Brothers Tyson and Ryan…

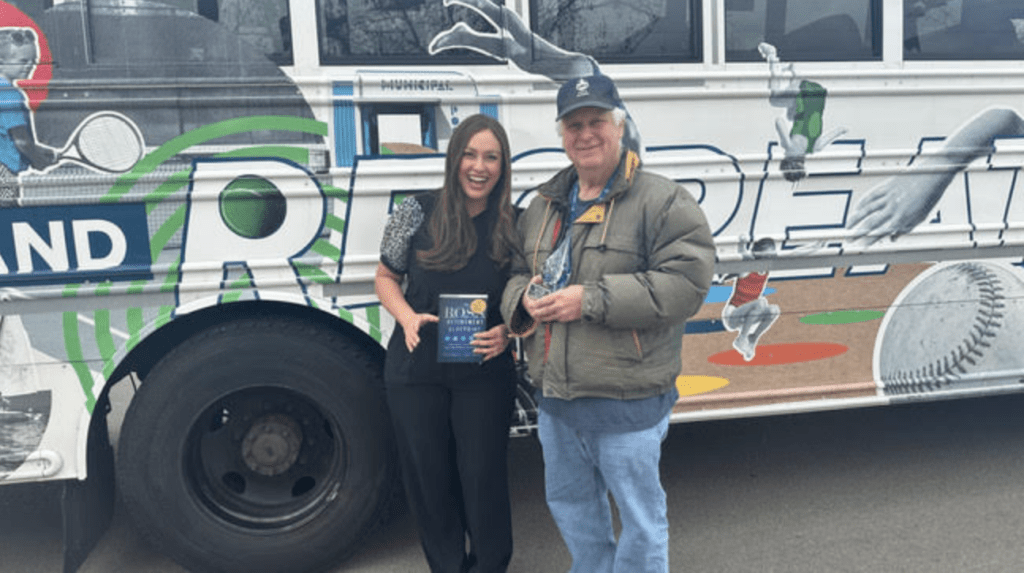

Read MoreHonoring Bus Driver for 14 years of Kindness

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — They say if you love what you do, you never work a day…

Read MoreHow much does it take…to retire successfully today?

How much money do you need to save … To retire successfully today? Is it $500,000? A million dollars? 5 million dollars? Have you come up with a number that…

Read MoreHope is NOT a financial strategy. What do YOU want from your money?

If past financial crises has caused you to pause and re-evaluate what you want your money to do for you, you are not alone. Tens of millions of Americans…

Read MoreTax troubles coming for IRAs and 401Ks over $200,000

“If you have more than $200,000 in a traditional IRA or 401K, your family could have a big problem coming in retirement,” warns financial advisor Ryan Thacker. “The problem is…

Read MoreWould you be upset if you lost $111,000 in retirement?

Filing for Social Security sounds simple on the surface. You take a specific percentage of every paycheck and it goes into the system when you’re working. And then when you…

Read MoreA 90-year-old woman volunteers at a senior center making children’s clothes

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — 90-year-old Mary Lou Hay says the key to a happy retirement is staying active.…

Read MoreRyan & Tyson Thacker Scheduled to Appear on Spotlight Television Hosted by Industry Legend Tom Hegna

These Retirement Brothers are solving the retirement crisis. Coming up on Fox Business is a special episode on how to get the most out of your Social Security benefits. By: Spotlight…

Read MoreIs there a tax “time bomb” hiding in your IRA & 401K?

The U.S. government has made it easy for you to save for retirement in a traditional IRA or 401K. But there’s a hidden risk that most people don’t see until…

Read MoreA Social Security Masterclass: Everything You Need to Know About Getting More From Your Benefits

Want to get the most out of your Social Security benefits? Did you know that 96% of Americans forfeit an average of $111,000 in social security income? And it’s all…

Read More