Retirement Experts Issue Critical Warning About Social Security

Retirement planning experts Tyson Thacker and Ryan Thacker have issued a critical warning to area residents who are planning to file for Social Security in the next five years.

Retirement experts Tyson Thacker and Ryan Thacker have issued a critical warning to area residents who are planning to file for Social Security in the next five years.

“Social Security is a critical part of your retirement income plan,” explains Tyson Thacker. “But you should know: Many Americans end up regretting their filing decision because they needlessly leave tens of thousands, if not hundreds of dollars on the table.”

Forbes highlights a staggering statistic: More than 90% of Americans lose out on an average of $182,000 in Social Security income due to filing for their benefits at the wrong time.

“You have one shot to file for Social Security. You have to get it right.”

– Tyson Thacker, B.O.S.S. Retirement Solutions

This loss, according to the Thacker brothers, stems from the complexity of the system.

The Social Security handbook alone contains 2,728 rules, with thousands of more rules governing these regulations. Ryan Thacker notes, “The complexity of Social Security often leads people to oversimplify their approach and miss out on crucial benefits.”

“You have one shot to file for Social Security. So, you have to get it right. You can’t change your filing later,” adds Tyson Thacker. “It’s important to consider all the benefits and consequences that come from your filing decision. And there’s no shame in getting help from a qualified expert.”

>>> Free Social Security Analysis to help you make your best filing decision

Tyson Thacker and Ryan Thacker are the CEO and President of B.O.S.S. Retirement Solutions, a six-time Best of State Award winner, with 10 offices located throughout the Mountain West and Pacific Northwest. Since 2008, they’ve helped 33,000+ families get the most out of their Social Security benefits.

“The typical household leaves $182,000 in lifetime Social Security benefits on the table by taking the wrong benefits at the wrong time.”

– Forbes

The Thackers stress that the difference between the best- and worst-case scenarios in claiming Social Security could mean you gain or lose hundreds of thousands of dollars in lifetime income.

“If you made an average income during your career, your Social Security benefits could add up to high six-figures,” explains Ryan Thacker. “For those who earned above-average incomes, the total could surpass a million dollars. Yet, it’s alarming how many people needlessly forfeit substantial amounts of money.”

One common misconception is that delaying benefits will always result in a larger overall payout. While benefits grow 8% annually when delayed, this isn't the optimal strategy for everyone. You can request an analysis to help you make your best filing decision here.

Tyson Thacker emphasizes, “What most people don’t realize is that filing for Social Security also impacts the taxes on your benefits, IRA and 401K withdrawals, and other investment income. It could even double your Medicare premiums. So, there are many cases where filing for your benefits early… could yield the most net income.

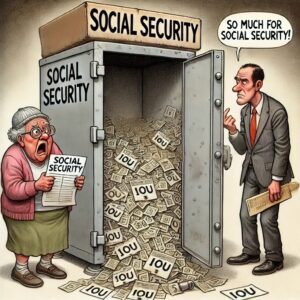

The Thackers also draw attention to the current state of the Social Security Trust Fund. The Congressional Budget Office estimates that without intervention, the fund could be depleted as soon as 2033, potentially leading to reduced benefits. If you’re retiring today, this could be right in the middle of your retirement. As a result, this could have a dramatic impact on how and when you should file for Social Security.

“What works for one person might not be the best for another.”

– Ryan Thacker, B.O.S.S. Retirement Solutions

Given these challenges, the Thackers recommend a personalized approach. “You can't rely on one-size-fits-all strategies,” says Ryan Thacker. “Every individual’s situation is unique, and therefore requires a tailored analysis to maximize benefits.”

To aid in this complex process, the Thackers and their team are offering a customized B.O.S.S. Social Security Analysis, free of charge.

This free analysis not only pinpoints the optimal timing to get the most net income from Social Security, while considering the tax implications on your benefits, IRA and 401K withdrawals and other investment income.

Some advisors charge hundreds of dollars for similar services. But B.O.S.S. Retirement Solutions offers this for free. Because they want to help area retirees navigate the complex system and find strategies that could help them maximize their income and live their best retirement.

The strategies used are especially beneficial for families who have saved at least $200,000 for retirement and have not yet filed for Social Security.

To schedule your free analysis that could unlock the full potential of your Social Security benefits, request your analysis online here.

About the Authors: Tyson Thacker and Ryan Thacker are the CEO and President of B.O.S.S. Retirement Solutions. They are published authors of the book, The B.O.S.S. Retirement Blueprint, and they've helped thousands of area families plan for a better, more secure retirement. They are six-time Best of State Award winners and have 10 offices located throughout the Mountain West and Pacific Northwest.

This is for illustrative purposes only, results may vary. Advisory services offered through B.O.S.S. Retirement Advisors, an SEC Registered Investment Advisory firm. Insurance products and services offered through B.O.S.S. Retirement Solutions. The information contained in this material is given for informational purposes only, and no statement contained herein shall constitute tax, legal or investment advice. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual's situation. You should seek advice on legal and tax questions from an independent attorney or tax advisor. BOSS submitted applications and paid application fees to be considered for the Utah Best of State for Retirement Planning awards. The award results were independently determined by the awarding organization's criteria (https://www.bestofstate.org/about.html) and the information BOSS provided in the applications. BOSS received the Utah Best of State award in 2019, 2020, 2021, 2022, 2023, and 2024. Our firm is not affiliated with the U.S. government or any governmental agency. Marketing materials provided by Infinity Marketing Services.

Continue browsing the B.O.S.S. Retirement Solutions website.

![2025-04 BOSS El Toro Article Image [Social Security Warning] 2025-04 BOSS El Toro Article Image [Social Security Warning]](https://bossretirement.com/wp-content/uploads/2025/04/2025-04-BOSS-El-Toro-Article-Image-Social-Security-Warning.png)

![2025-04 BOSS El Toro Banners [New Social Security Guide] 300x250-px 2025-04 BOSS El Toro Banners [New Social Security Guide] 300x250-px](https://bossretirement.com/wp-content/uploads/2025/04/2025-04-BOSS-El-Toro-Banners-New-Social-Security-Guide-300x250-px.png)

![2025-04 BOSS El Toro Banners [New Social Security Guide] 300x600-px 2025-04 BOSS El Toro Banners [New Social Security Guide] 300x600-px](https://bossretirement.com/wp-content/uploads/2025/04/2025-04-BOSS-El-Toro-Banners-New-Social-Security-Guide-300x600-px.png)

![2025-04 BOSS El Toro Banners [New Social Security Guide] 728x90-px 2025-04 BOSS El Toro Banners [New Social Security Guide] 728x90-px](https://bossretirement.com/wp-content/uploads/2025/04/2025-04-BOSS-El-Toro-Banners-New-Social-Security-Guide-728x90-px.png)