How to Create a Reliable Retirement Income Plan: Beyond Your IRA/401(k)

Generating Income in Retirement

When it comes to retirement, saving money is just the beginning. It’s what you do with those savings that really matters.

You might be surprised to learn that generating income in retirement today is more challenging than ever before. The traditional options many retirees relied on in the past simply aren’t working anymore.

The Two Retirement Income Camps

When you retire, you’ll likely find yourself in one of two camps.

1. You’re living off your retirement savings

Every time you write a check or charge your credit card, you watch your savings shrink. This creates constant fear about running out of money in retirement – definitely not the way you want to spend your golden years.

2. Your money is working for you, with different sources of income arriving every month like clockwork

This is where you want to be! This reliable income enables you to do all the things you’ve dreamed of in retirement – spending money on your grandkids, making bucket list trips, or even buying that dream vacation home.

Why Traditional Retirement Income Options Aren’t Working

Traditional fixed income options like CDs and savings accounts are no longer viable retirement income sources. When you factor in taxes and inflation, these “safe” investments actually increase the chance you’ll lose money.

Meanwhile, many people fear investing in the stock market because of its volatility. They worry about risking their principal, especially after seeing the market’s wild swings in recent years.

Creating Multiple Income Streams

The key to successful retirement income planning is having several streams of income from different non-correlated sources. The more diversified these income sources are, the better protected you’ll be during:

- Inflation periods

- Market downturns

- Recessions

You’re bound to experience all of these during your retirement years. That’s why proper planning is critical.

The Importance of Customized Planning

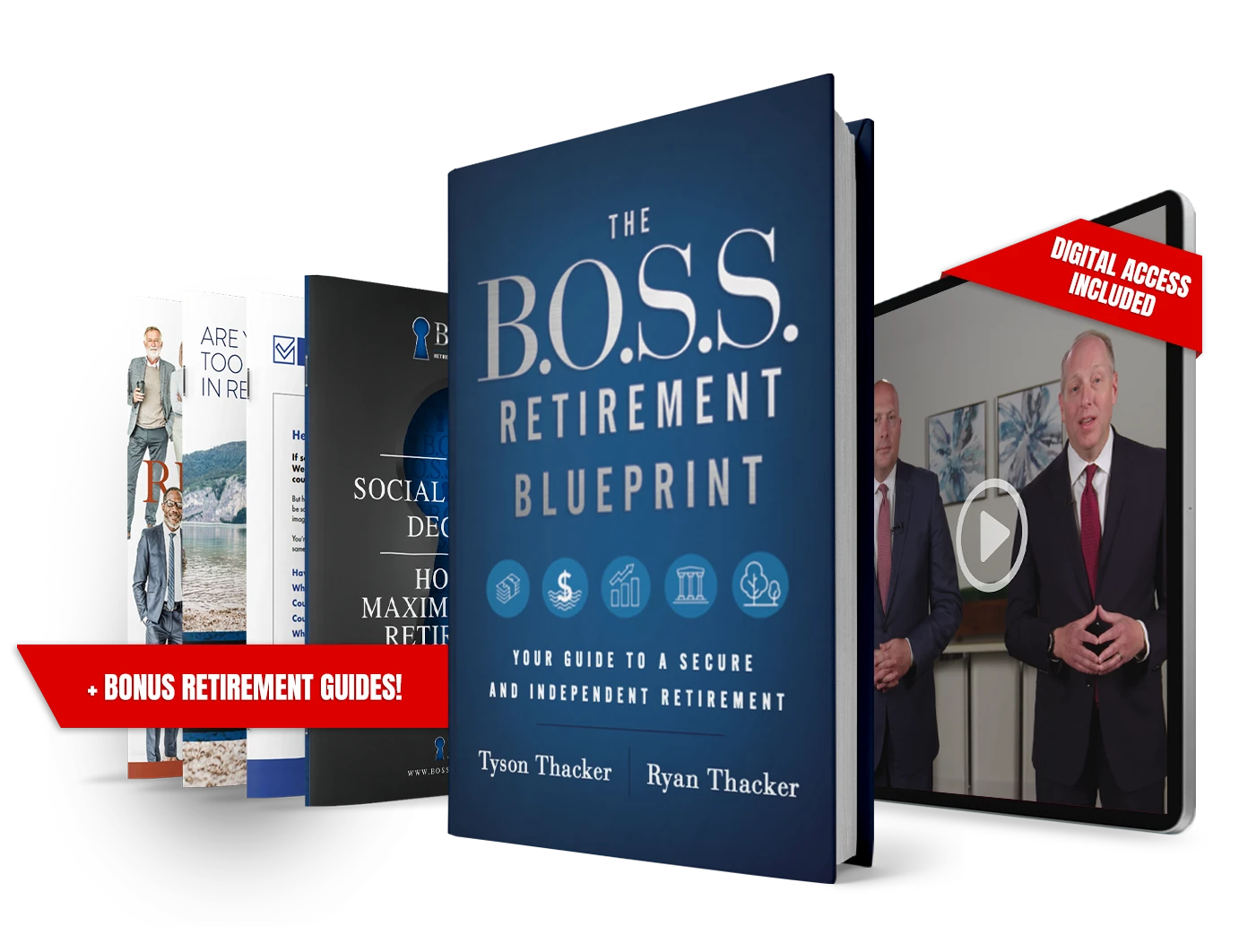

Every retiree’s situation is unique. That’s why B.O.S.S. Retirement Solutions offers a comprehensive retirement income analysis called the B.O.S.S. Retirement Blueprint.

This customized plan helps ensure your money generates the income you need throughout retirement. The Blueprint covers critical areas like:

- Tax reduction strategies

- Healthcare cost planning

- Investment risk management

- Social Security optimization

- Income generation methods

Many advisors charge thousands of dollars for this type of analysis. However, B.O.S.S. Retirement Solutions does all the heavy lifting at no cost to you.

Taking Action for Your Retirement

If you’ve saved at least $200,000 for retirement and don’t have a solid income plan, it’s time to take action. You’ve worked too hard to leave your retirement income to chance.

The B.O.S.S. Retirement BlueprintTM can help you:

- Create reliable income streams

- Reduce your taxes

- Protect against market volatility

- Plan for healthcare costs

- Maximize your Social Security benefits

To get your free B.O.S.S. Retirement BlueprintTM analysis, call 800.637.1031. Remember, retiring successfully doesn’t happen by accident. It starts with a solid plan.

Don’t Wait to Create Your Income Plan

The sooner you start planning your retirement income strategy, the more options you’ll have. Don’t make the mistake of focusing only on saving money while ignoring how you’ll turn those savings into reliable income.

Your retirement dreams deserve more than just hoping your savings will last. They deserve a comprehensive plan that ensures your money works as hard for you in retirement as you did saving it.

Take the first step toward retirement income confidence today. Call 800.637.1031 to schedule your free B.O.S.S. Retirement BlueprintTM analysis. The advisors at B.O.S.S. Retirement Solutions can help you create a retirement income plan that gives you the security and lifestyle you’ve worked so hard to achieve.

Remember, it’s not just about having enough money saved for retirement – it’s about having a solid plan to turn those savings into reliable income that will last as long as you do. Don’t leave your retirement income to chance. Call 800.637.1031 today to get started on your personalized retirement income plan.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.