How to Maximize Your Social Security Benefits: A Complete Guide for Retirees

How to Maximize Your Social Security Benefits

Did you know that 96% of Americans leave an average of $111,000 in Social Security benefits on the table? That’s money that could make a significant difference in your retirement years. Let’s explore how you can avoid becoming part of this statistic and maximize every dollar of your Social Security benefits.

Why Social Security Matters More Than Ever

Social Security isn’t just another retirement income stream – it’s the foundation of your retirement plan. For 30% of Americans, it’s their largest source of income. Even more striking, for 90% of retirees, it could be their only source of income.

That’s why making the right decisions about your Social Security benefits is crucial. One wrong move could cost you tens or even hundreds of thousands of dollars over your lifetime.

Understanding the Complexity of Social Security

Many people think claiming Social Security is simple – you just pick an age and start receiving checks. However, there are actually 2,728 rules in the Social Security handbook, plus hundreds of thousands of additional rules about those rules.

This complexity is why so many Americans make costly mistakes when claiming their benefits. You need to understand how these rules work together and how they affect your overall retirement picture.

The Tax Trap Nobody Tells You About

Here’s something that catches many retirees by surprise: you could be taxed on up to 85% of your Social Security benefits. This tax requirement started in 1983, and unlike many other tax provisions, the income thresholds haven’t been adjusted for inflation.

For married couples making over $44,000 per year (including half of your Social Security benefits plus other income), up to 85% of your benefits could be subject to federal income tax. That means your actual benefit could be significantly less than what you see on your Social Security statement.

Common Mistakes to Avoid in Claiming Social Security Benefits

The biggest mistake people make is following one-size-fits-all advice. You’ve probably heard these common recommendations:

- “Take benefits as early as possible at 62”

- “Wait until 70 to get the maximum benefit”

Neither of these strategies is automatically right for everyone. Your optimal claiming strategy depends on multiple factors:

- Your health and family longevity

- Your spouse’s benefits

- Other income sources

- Tax situation

- Medicare premiums

- Overall retirement plan

The Medicare Premium Connection

Many people don’t realize that when they claim Social Security can affect their Medicare premiums. Taking benefits at the wrong time could actually double your Medicare costs. This is why you need to consider your Social Security claiming strategy as part of your complete retirement picture.

Creating Your Social Security Strategy

To maximize your benefits, consider these key factors:

1. Timing Is Everything

Your benefit amount changes depending on when you claim. While waiting longer generally means a bigger monthly check, that’s not always the best strategy. You need to consider:

- Your other income sources

- Required Minimum Distributions (RMDs) from retirement accounts

- Tax implications

- Health factors

2. Consider Your Spouse

If you’re married, your claiming decision affects your spouse’s benefits too. A surviving spouse could receive up to 100% of your benefit amount, making it crucial to consider both lives in your planning.

3. Tax Planning

Strategic planning can help reduce or eliminate taxes on your benefits. This might include:

- Converting traditional IRAs to Roth IRAs

- Timing your retirement account withdrawals

- Structuring your other retirement income

4. Look at the Complete Picture

Your Social Security strategy should be part of your overall retirement plan, including:

- Income needs

- Healthcare costs

- Investment risk

- Tax efficiency

- Estate planning

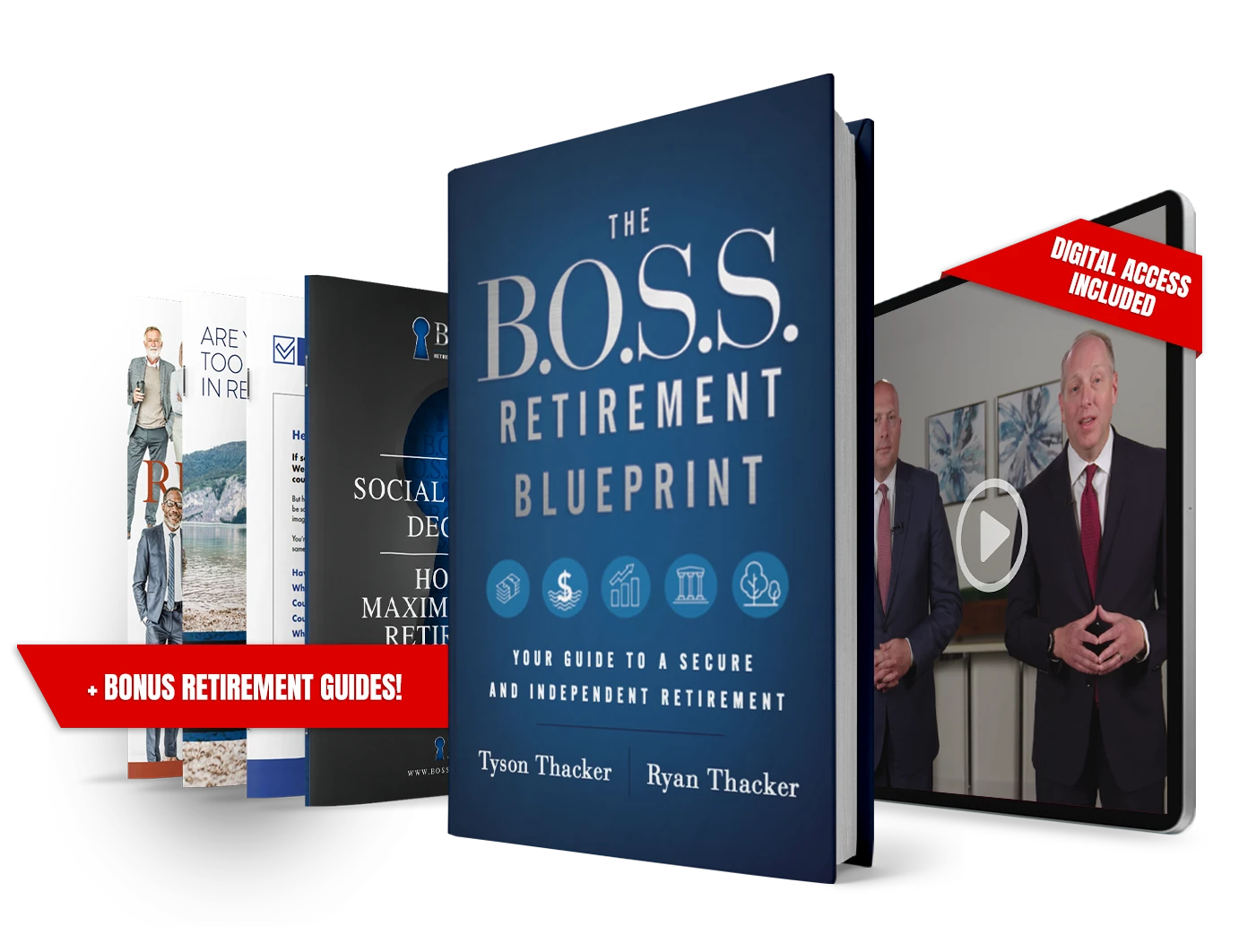

The B.O.S.S. Retirement Blueprint™ Approach

At B.O.S.S. Retirement Solutions, we use what we call the B.O.S.S. Retirement Blueprint™ to help create a comprehensive plan. This approach looks at five key areas:

- Cash Bucket – Emergency funds and liquid assets

- Income Bucket – Social Security and other income sources

- Growth Bucket – Investment strategies

- Tax Bucket – Tax efficiency planning

- Legacy Bucket – Estate planning considerations

Taking Action to Maximize Your Social Security Benefits

Here are the steps you should take to maximize your Social Security benefits:

- Get a copy of your Social Security statement and verify its accuracy

- Understand all your income sources for retirement

- Calculate your expected tax situation

- Consider your health and family longevity

- Look at your spouse’s benefits

- Create a comprehensive retirement plan

- Get professional help to analyze your options

Why Professional Help is Vital

While the Social Security Administration staff are helpful, they’re not allowed to give you claiming advice or strategy recommendations. They can’t consider your complete financial picture or help you maximize your benefits.

That’s why working with a qualified financial advisor who understands Social Security strategies is crucial. They can help you avoid costly mistakes and create a plan that maximizes your benefits while minimizing taxes and other costs.

Take the Next Step to Get More for Your Retirement

Don’t risk losing out on thousands of dollars in benefits by making the wrong claiming decision. B.O.S.S. Retirement Solutions has helped over 30,000 families make informed Social Security decisions.

If you’ve saved at least $200,000 for retirement and haven’t filed for Social Security yet, you can get a free customized Social Security analysis. This analysis will show you:

- The exact timing that could help you get the most benefits

- How to minimize or eliminate taxes on up to 85% of your benefits

- Ways to avoid doubling your Medicare premiums

- Strategies for maximizing spousal benefits

- Additional benefits you might be eligible for

Many advisors charge hundreds of dollars for this type of analysis, but B.O.S.S. Retirement Solutions offers it free to qualified individuals. Call 800-918-3015 today to schedule your free analysis and ensure you’re not leaving money on the table with your Social Security benefits.

Remember, retiring successfully doesn’t happen by accident. It starts with proper planning and understanding all your options. Take the first step today toward maximizing your Social Security benefits and securing your retirement future.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.