The Social Security Trust Fund’s Running Dry: What You Need to Do Before 2033

The Social Security Trust Fund is Running Out!

The news about Social Security isn’t good. According to recent reports from the Social Security Administration’s Board of Trustees, the Social Security Trust Fund is set to run out of money by 2033 – less than 10 years from now.

This isn’t just another headline. For millions of Americans counting on Social Security for retirement, this development could mean significant changes to their retirement plans.

Understanding the Crisis

The problem is simple mathematics. There are too many baby boomers retiring and not enough new workers entering the workforce to replace them. The Social Security system is facing more people to pay out benefits to, but significantly fewer sources to tax.

Making matters worse, people are living much longer than when the program was first designed. Social Security was originally meant to support people for less than 10 years of retirement, not 20 or 30 years like it does today.

What Happens When the Trust Fund Runs Out?

Here’s the good news – Social Security won’t completely disappear even if nothing changes. If the trust fund runs dry in 2033, beneficiaries would still receive about 75% of their scheduled benefits.

However, this 25% reduction could significantly impact your retirement lifestyle. For many Americans, this cut could mean the difference between a comfortable retirement and serious financial struggles.

Why Congress Hasn’t Fixed It Yet

Former federal government comptroller David Walker recently testified before Congress about this critical issue. The challenge is that most lawmakers are reluctant to be the “bad cop” who has to tell their constituents about necessary but unpopular changes to the program.

This political paralysis is particularly concerning when you consider that Social Security is the only source of income for 59% of American retirees. Any reduction in benefits could have devastating effects on millions of seniors.

How This Could Affect Your Benefits

The impact of these changes could vary significantly depending on when you plan to claim your benefits. Here’s what you need to consider:

- If you’re planning to retire before 2033, you might want to factor in potential benefit reductions into your retirement planning

- If you’re younger, you need to prepare for the possibility of reduced benefits or delayed retirement age

- Your claiming strategy might need to be adjusted based on these upcoming changes

What Can You Do to Protect Yourself?

While the situation may seem dire, there are several steps you can take to protect your retirement:

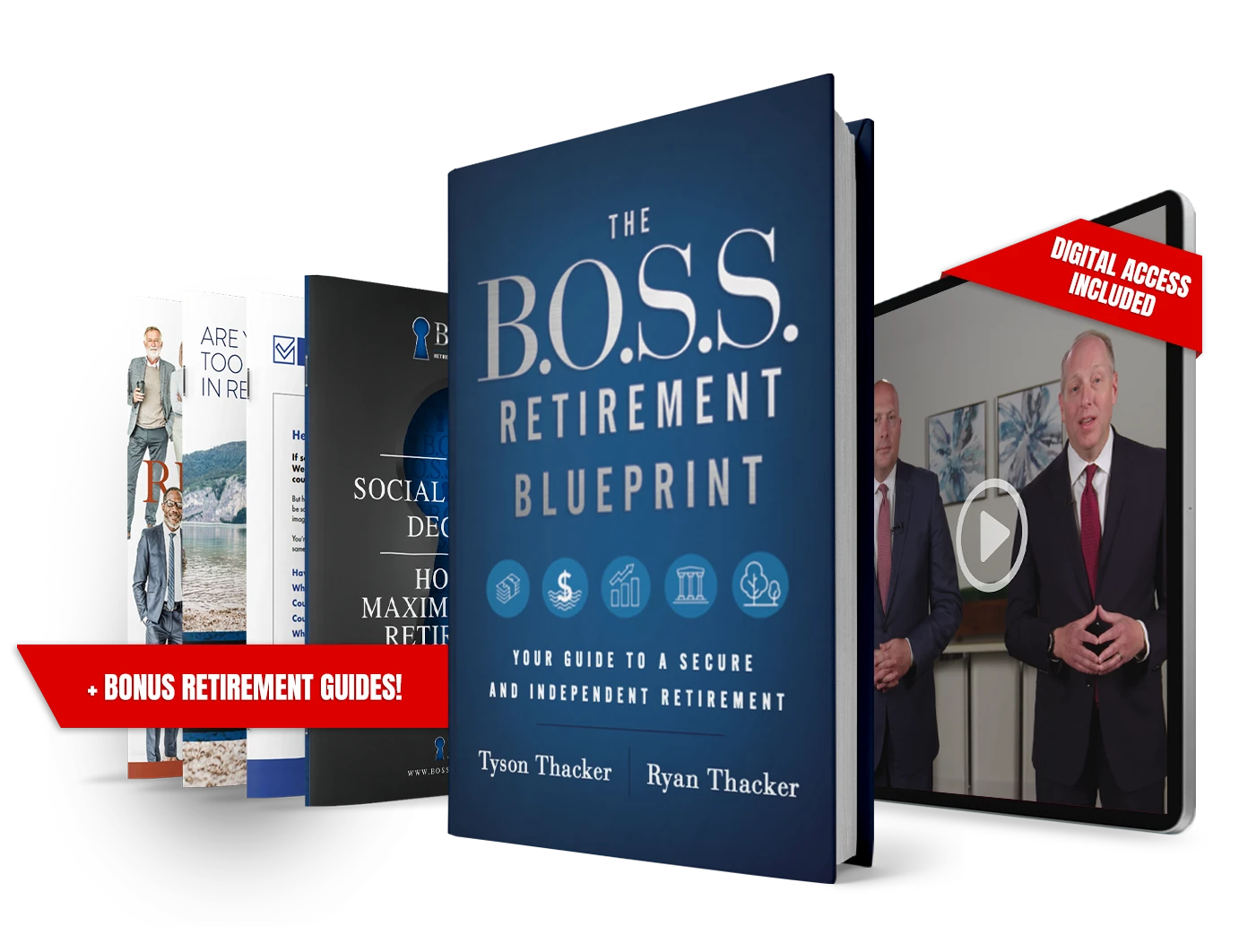

1. Get a Professional Analysis

The team at B.O.S.S. Retirement Solutions has helped over 30,000 families make informed decisions about their Social Security benefits. They can help you understand how these changes might affect your specific situation.

2. Look at Your Entire Financial Picture

Don’t make Social Security decisions in isolation. Consider all your income sources, including:

- IRAs and 401(k)s

- Pension payments

- Investment income

- Real estate income

- Other retirement savings

3. Consider Your Tax Implications

Remember that up to 85% of your Social Security benefits could be taxable, depending on your other income sources. This percentage could increase as Congress looks for ways to shore up the program.

The New Way to Think About Social Security

The old rules about claiming Social Security are being turned upside down. Traditional wisdom suggested waiting until age 70 to maximize your benefits, but that may not be the best strategy anymore.

Instead of focusing solely on getting the biggest possible monthly check, you need to consider:

- Your health and family longevity

- Other income sources

- Tax implications

- Potential benefit reductions

- Impact on Medicare premiums

Warning Signs You Can’t Ignore

The Social Security Administration has been sending warning signals:

- The trust fund depletion date hasn’t improved from last year

- No significant reforms are currently on the horizon

- The system continues to pay out more than it takes in

What Congress Might Do

While no one can predict exactly what changes Congress will make to save Social Security, possible solutions might include:

- Extending the retirement age

- Lifting the cap on Social Security taxes

- Increasing payroll taxes

- Reducing benefits for higher-income retirees

- Some combination of these approaches

Why You Need Professional Help

With 2,728 rules in the Social Security handbook and thousands of additional rules that pivot off those rules, making the right claiming decision has never been more complex. Add in the uncertainty about the trust fund’s future, and it becomes clear why professional guidance is crucial.

Making the wrong decision could cost you tens or even hundreds of thousands of dollars in lifetime benefits. According to Forbes, 96% of Americans forfeit an average of $111,000 in Social Security income by making sub-optimal claiming decisions.

Take Action Now to Protect Your Social Security Income

Don’t wait until the trust fund runs out to start planning. The time to act is now, while you still have more options available.

B.O.S.S. Retirement Solutions offers a free, customized Social Security analysis that can help you understand:

- The exact timing that could help you get the most income from Social Security

- How to reduce or eliminate taxes on up to 85% of your benefits

- Ways to avoid doubling your Medicare premiums

- Strategies to protect against potential benefit reductions

Your Next Steps to Maximize Your Retirement Income

If you’ve saved at least $200,000 for retirement and haven’t filed for Social Security yet, you can get a free customized analysis that could help protect your retirement from potential benefit cuts.

While many advisors charge hundreds of dollars for this type of analysis, B.O.S.S. Retirement Solutions is offering it at no cost to help people prepare for these upcoming changes.

Don’t leave tens of thousands of dollars in benefits on the table. Call 800-918-3015 today to schedule your free B.O.S.S. Social Security analysis. Remember, retiring successfully doesn’t happen by accident – it starts with proper planning.

As Congress continues to delay action on Social Security reform, the window for optimal claiming strategies grows shorter. The decisions you make today could impact your retirement income for decades to come. Make sure you have all the information you need to make the best possible choice for your future.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.