When is the Best Age to File for Social Security?

Did you know… 96% of Americans forfeit an average of $111,000 in social security income… And it’s all because they file for their benefits… at the wrong time. Discover how…

Everything You Need to Know About Withdrawing Money From Your Savings in Retirement

What is your strategy to withdraw money from your nest egg in retirement? Which accounts should you tap first? And how much can you safely withdraw every year … Without…

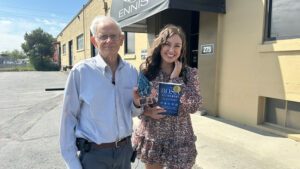

Local man celebrated for 20+ years of service to Greek Food Festival

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — The Greek Food Festival is one of the biggest cultural events in Boise and it…

The New Retirement Reality for the Next Wave of Retirees!

Stubborn inflation. Stock market volatility. High interest rates and a troubled economy. The next generation of retirees face a whole new set of challenges that could threaten their financial security.…

5 Ways to Maximize Your IRA & 401K in Retirement

How much money have you saved in your IRA or 401K? Making contributions to one of these tax-deferred retirement accounts is easy. But withdrawing this money in retirement … gets…

Art of upholstery: Celebrating local craftsman for 57 years of work

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — BOISE, Idaho (CBS2) — Upholstery isn’t a glamorous job, but it’s something that’s kept…

The Best Kept Tax Secrets That Uncle Sam Doesn’t Want You to Know

Did you know, you have more control over how much you pay in taxes in retirement … than at any other time of your life? It’s true! And if you…

Tune In to Fox Business Network for a Half Hour with Retirement Experts Ryan & Tyson Thacker

Considered the country’s leading experts on Social Security, find out how to maximize your benefits with Retirement Brothers Ryan and Tyson Thacker. By: Spotlight Television The Retirement Brothers Tyson and Ryan…

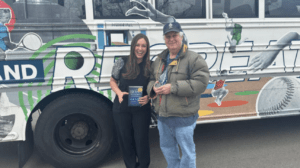

Honoring Bus Driver for 14 years of Kindness

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — They say if you love what you do, you never work a day…

Ready to Take

The Next Step?

For more information about any of our products and services, schedule a meeting today.