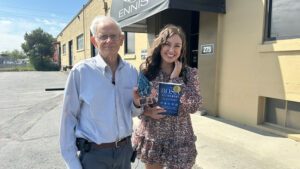

Art of upholstery: Celebrating local craftsman for 57 years of work

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — BOISE, Idaho (CBS2) — Upholstery isn’t a glamorous job, but it’s something that’s kept…

The Best Kept Tax Secrets That Uncle Sam Doesn’t Want You to Know

Did you know, you have more control over how much you pay in taxes in retirement … than at any other time of your life? It’s true! And if you…

Tune In to Fox Business Network for a Half Hour with Retirement Experts Ryan & Tyson Thacker

Considered the country’s leading experts on Social Security, find out how to maximize your benefits with Retirement Brothers Ryan and Tyson Thacker. By: Spotlight Television The Retirement Brothers Tyson and Ryan…

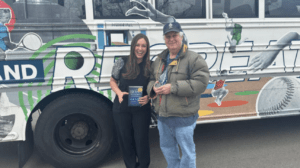

Honoring Bus Driver for 14 years of Kindness

B.O.S.S. Retirement Solutions is proud to sponsor the Treasure Valley Silver Awards By: Idahonews.com BOISE, Idaho (CBS2) — They say if you love what you do, you never work a day…

5 Social Security Misconceptions That Could Needlessly Cost You a Fortune

You may not realize it … But filing for social security could be one of the most important financial decisions of your life. Because the difference between your best and…

How much does it take…to retire successfully today?

How much money do you need to save … To retire successfully today? Is it $500,000? A million dollars? 5 million dollars? Have you come up with a number that…

Hope is NOT a financial strategy. What do YOU want from your money?

If past financial crises has caused you to pause and re-evaluate what you want your money to do for you, you are not alone. Tens of millions of Americans…

Tax troubles coming for IRAs and 401Ks over $200,000

“If you have more than $200,000 in a traditional IRA or 401K, your family could have a big problem coming in retirement,” warns financial advisor Ryan Thacker. “The problem is…

Would you be upset if you lost $111,000 in retirement?

Filing for Social Security sounds simple on the surface. You take a specific percentage of every paycheck and it goes into the system when you’re working. And then when you…

Ready to Take

The Next Step?

For more information about any of our products and services, schedule a meeting today.